(Aug 15, 2011) Over ten years ago, the canola trade created the illusion there is no freight on canola by changing the pricing point for futures to Saskatoon instead of Vancouver. In theory that reduced the basis by $30-40/t. However, the export (Vancouver) price is still higher than Saskatoon by at least the cost of the freight. The price farmers receive at the elevator is still less than the export price by the cost of freight to port as well as the basis deduction from the futures price at Saskatoon (The farmer isn’t actually paying the rail freight but the value of his canola inland is lowered by that amount just the same).

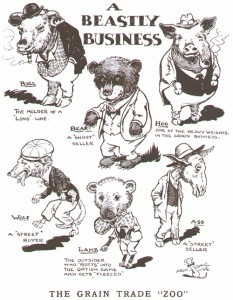

Also buried in the private trade’s basis are handling, risk management and financing costs, profit margin, incentive or disincentive for farmers to deliver and any other costs, again with little transparency on individual items.

There will be price differences due to location or logistics costs built into the basis as well as potentially widening or squeezing of the company’s margin. But, essentially everyone in the trade is buying and selling based on a common futures price, plus or minus a basis that they should be able to calculate for their situation. However, the problem for farmers is they usually do not know that Company A sold their canola to Japan for futures plus $40 after buying it from them at futures minus $50. The farmer does not know if he paid the freight to Vancouver and does not know if he was paid a fair price other than knowing his $50 basis was wider than what he usually experienced.